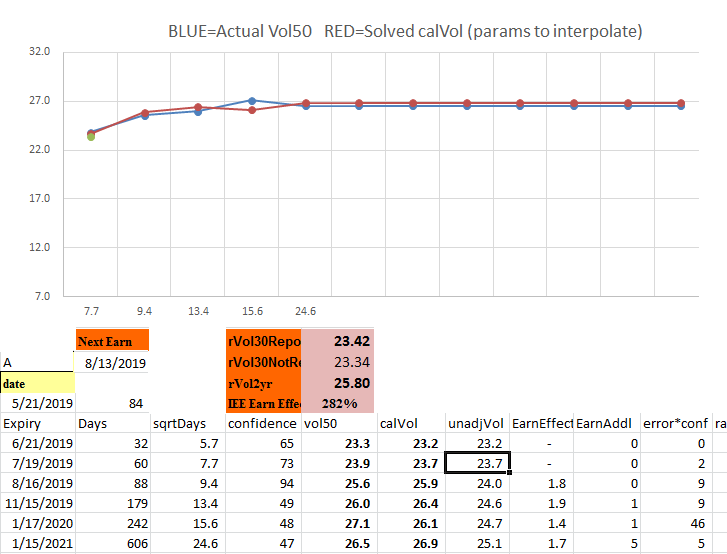

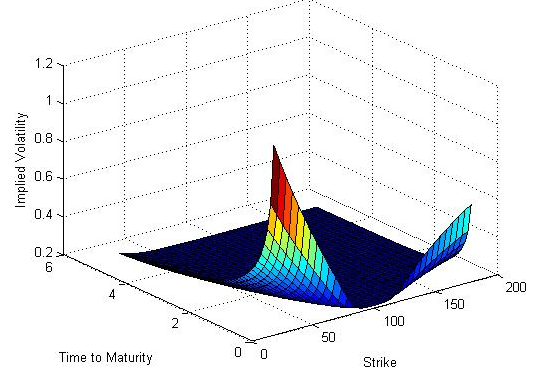

Term structure for the approximated implied volatility surface: the... | Download Scientific Diagram

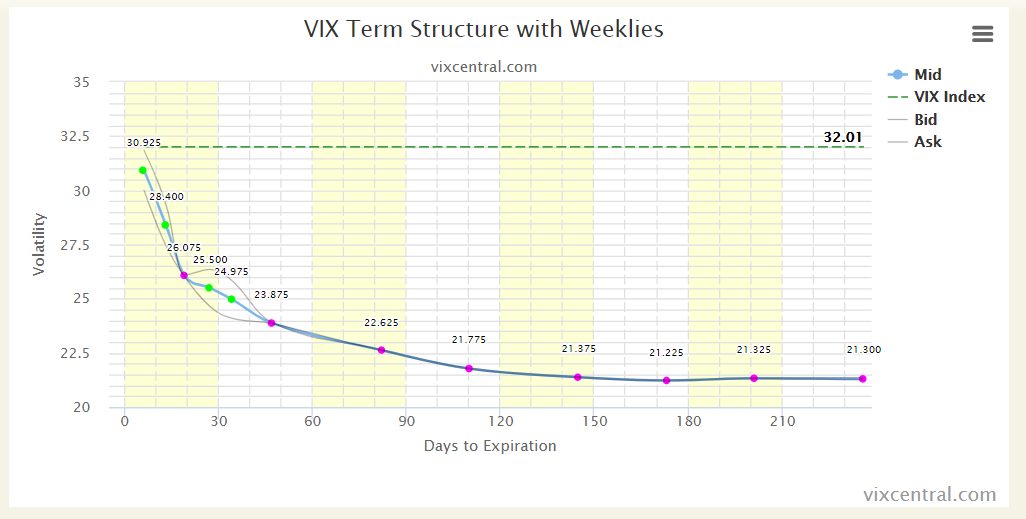

a) Term Structure-Cross section of the term structure for the implied... | Download Scientific Diagram

Figure 1 from The Small-Time Smile and Term Structure of Implied Volatility under the Heston Model | Semantic Scholar

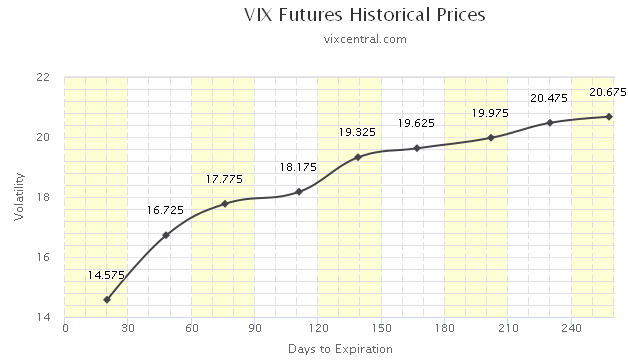

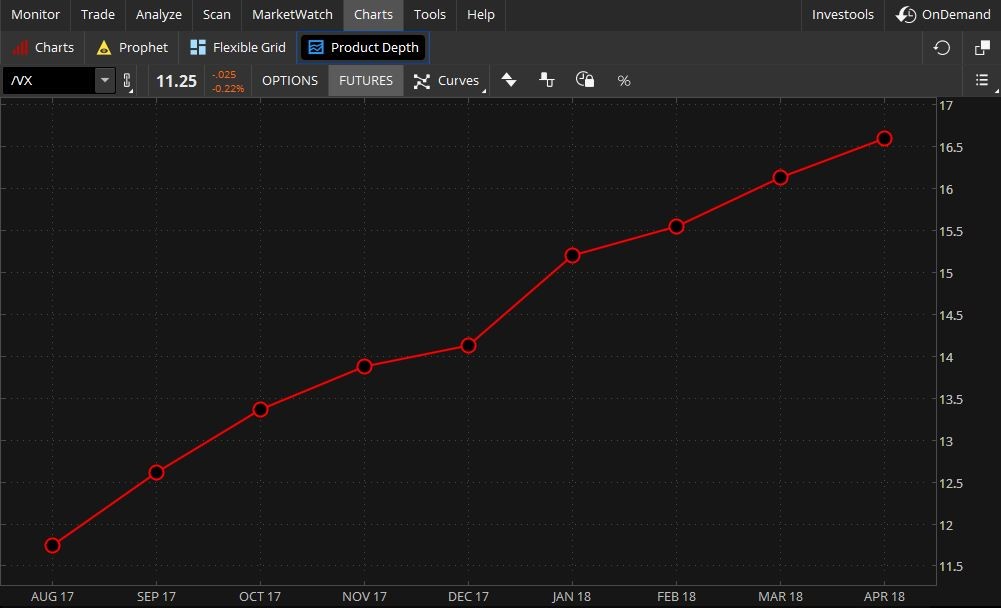

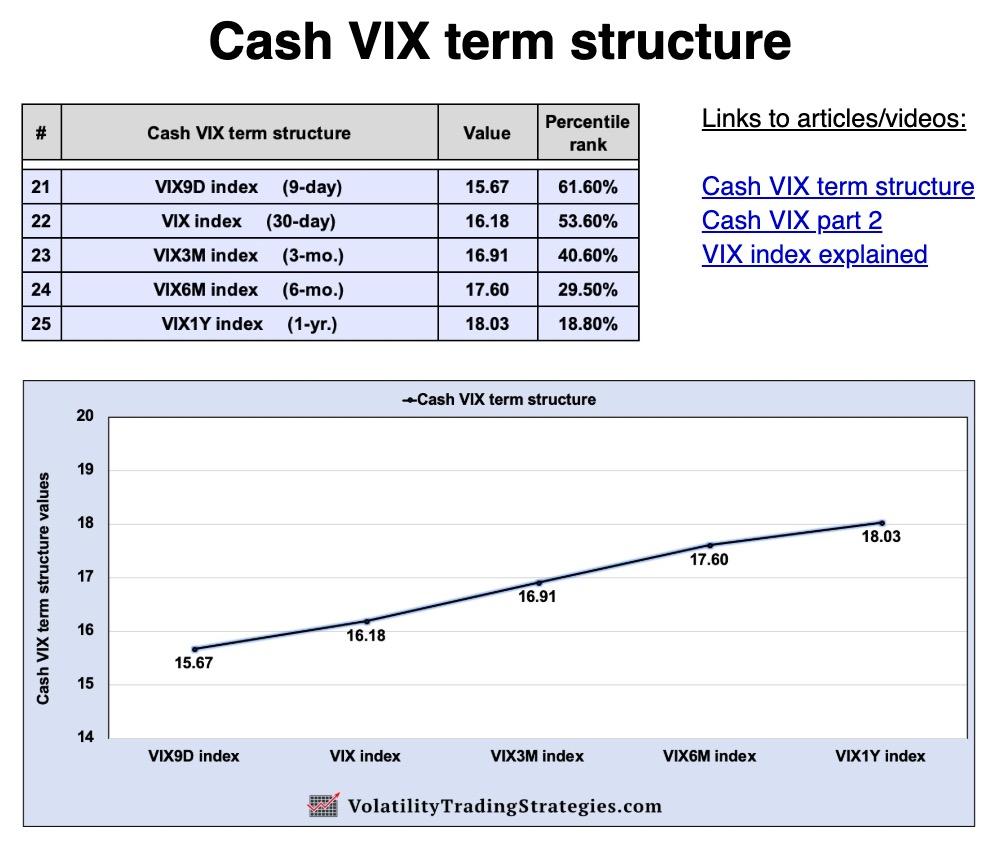

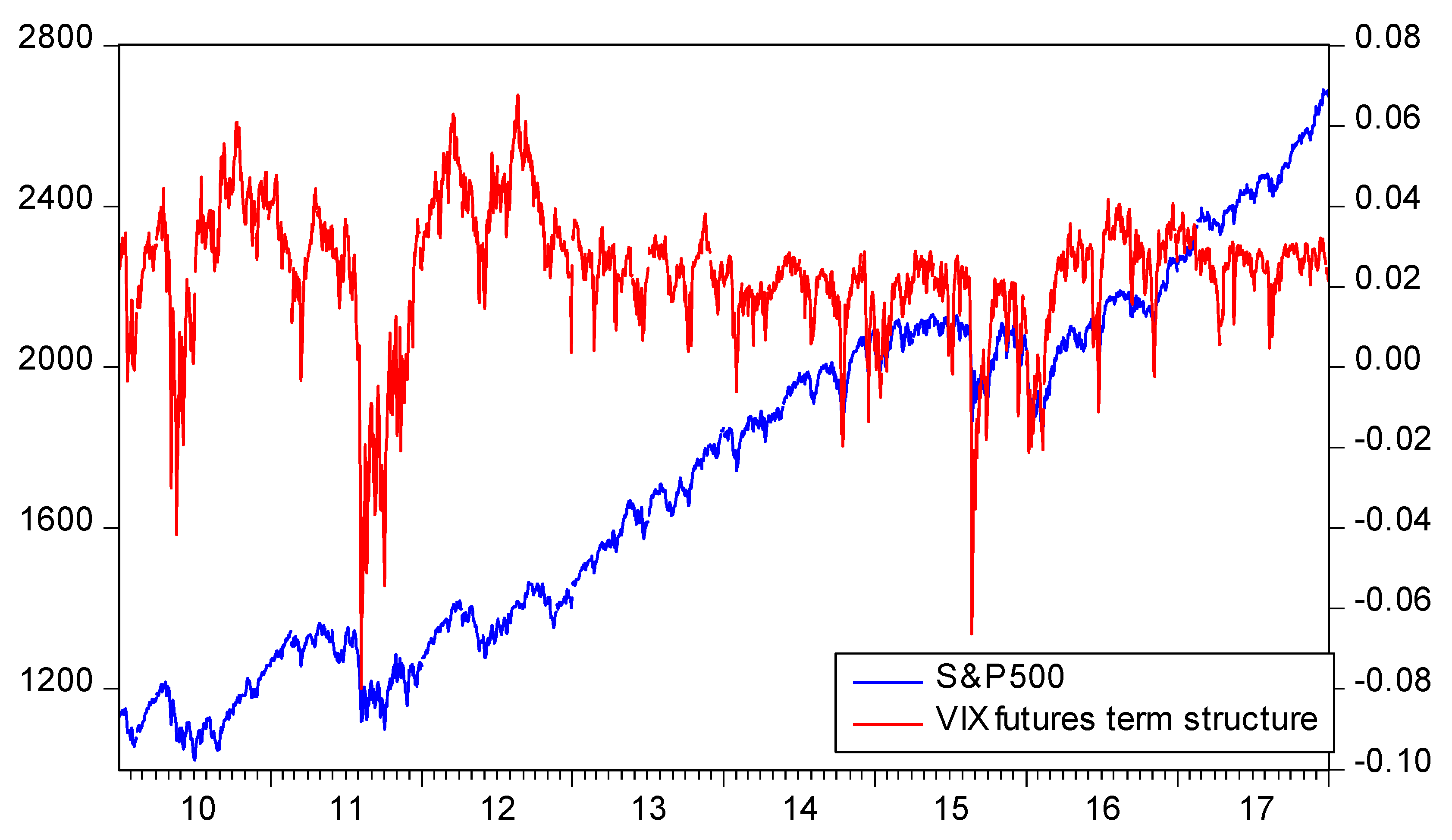

The Cash VIX Term Structure, And How These Volatility Metrics Can Be Used To Time The Market | Seeking Alpha

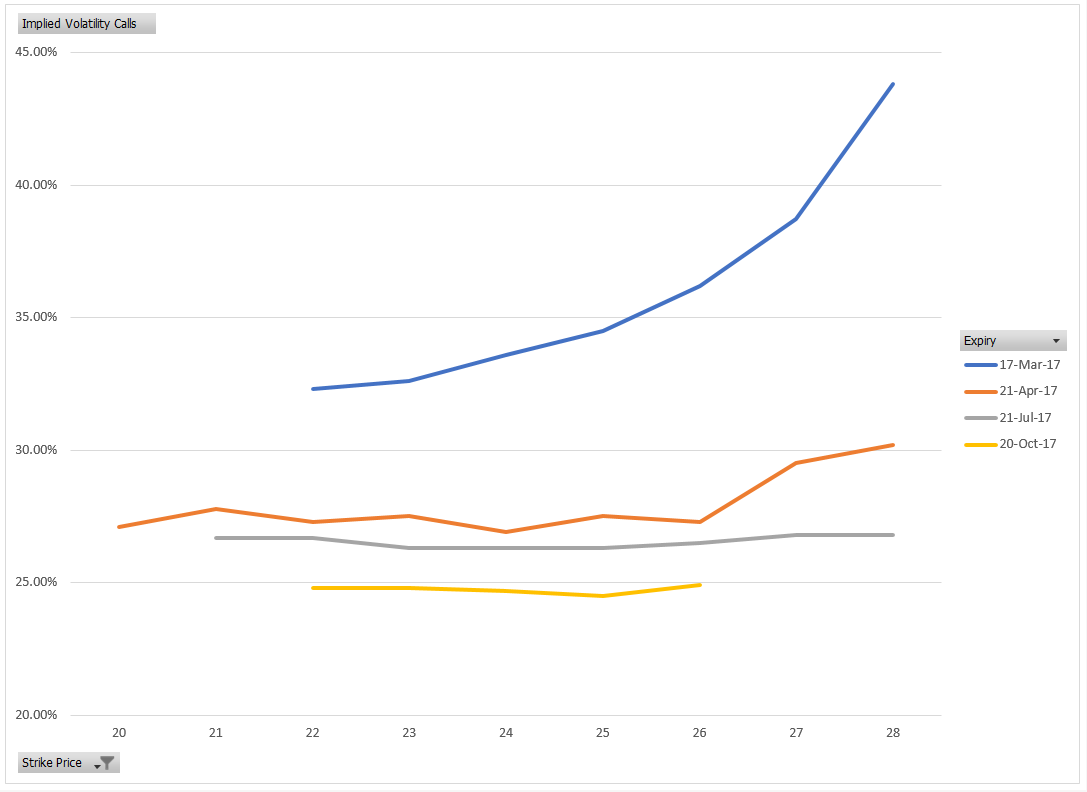

option pricing - Why is the term structure of the implied volatility surface non-monotonic? - Quantitative Finance Stack Exchange

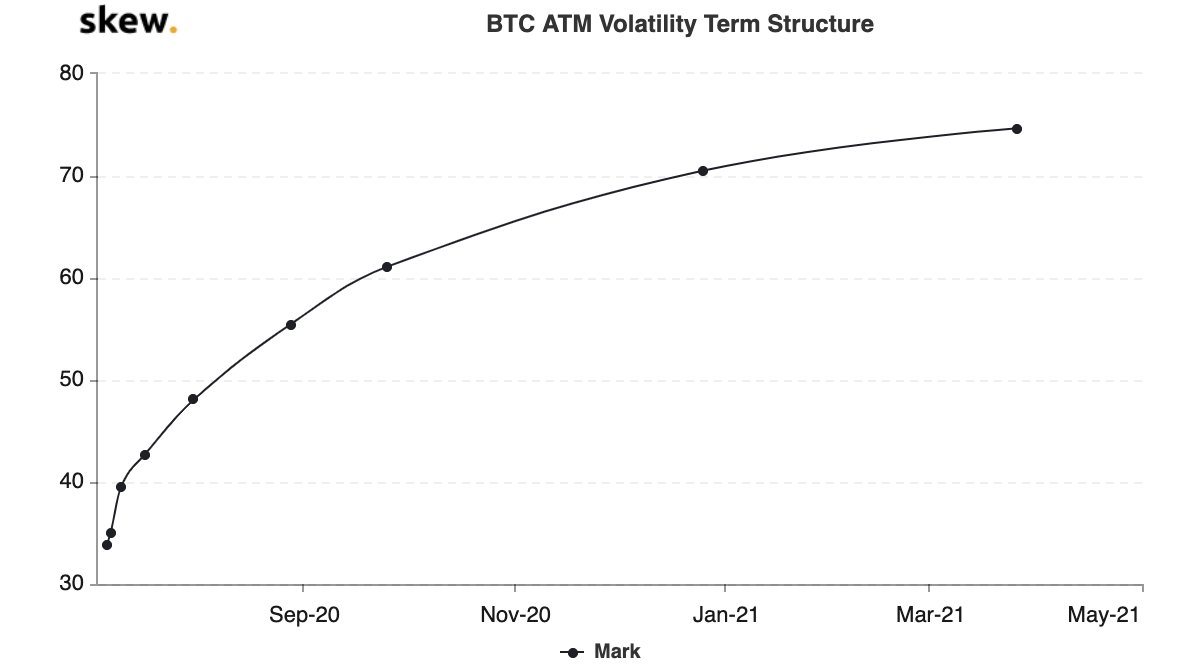

توییتر \ skew در توییتر: «#bitcoin having one of its very quiet moment, implied volatility term structure is record steep https://t.co/5gvu1h95kW»

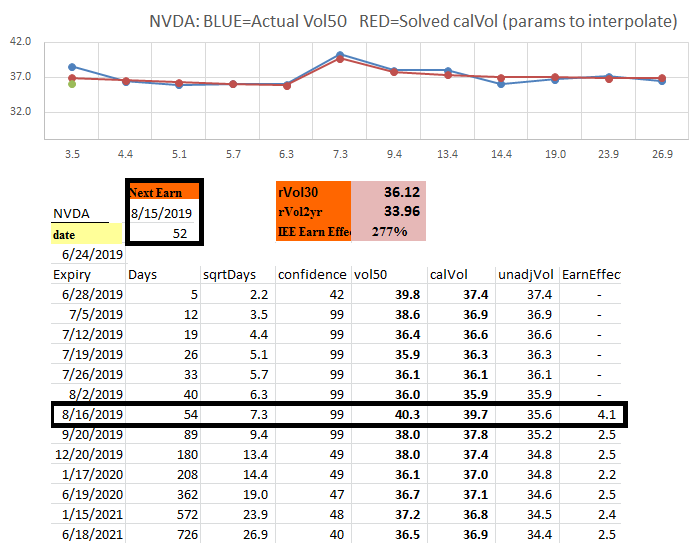

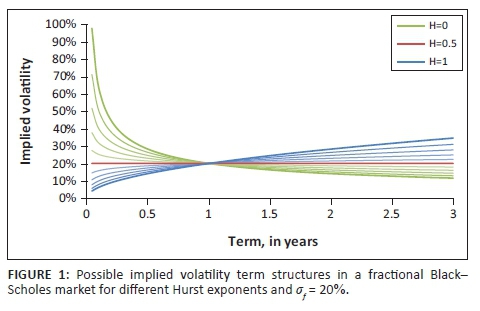

Fractional Black-Scholes option pricing, volatility calibration and implied Hurst exponents in South African context

:max_bytes(150000):strip_icc()/0_xXF9J5QFpmkGkyf8-fb14d2e0fb314dbea11f8af549b7eb5f.jpg)